Your child’s first experience with banking is probably a cute piggy bank filled with loonies and toonies. But, eventually, they may want to do more with money, like send some to a friend, or family member. The next step is to graduate them to their very own bank account, where they can not only see their money grow but also do more with it as well.

Here’s how to decide which bank account is right for your child, and some of the options currently available for children and students.

Why kids need a bank account

One of the reasons our founders created the Mydoh money app and Smart Card for teens and kids was to help young people learn about financial literacy and manage money. Mydoh helps kids earn and spend their own cash, putting them on the path of financial responsibility. While there’s nothing stopping parents from opening a bank account for their child (if they haven’t done so already), we think there’s a benefit to getting your kids involved in the process once they’re old enough.

A separate bank account for your child makes sense in terms of giving them the independence to do more with their money—like sending some to a friend, or having somewhere to put gifts from grandparents or other family members. But more than that, it’s an opportunity for your child to get real-world experience of something we all do in our day-to-day adult lives: banking.

Kids are more likely to feel real ownership for their growing wealth and managing their money, if they’re given the opportunity to open their own account—one with their name on it! It’s an opportunity to encourage your child to ask questions about the Canadian financial system and why banks exist. There’s also something gratifying about saving money as a kid and watching your savings grow overtime.

How to decide which bank account is right for your child

With so many financial products on the market, you may be wondering which ones are the best option for your kids. Granted, you’re usually trading off no fees for small interest rates, but looking for an account that isn’t going to take a bite out of your kids’ savings will probably pay off more in the long run. You also want to make sure there aren’t too many hurdles accessing the account or that your child needs to maintain a minimum balance.

Here are 5 things to consider when comparing bank accounts for kids:

- Monthly fees

- Minimum balance

- Number of transactions each month

- Interac e-transfers

- Easy access to ATMs

RBC bank accounts for kids

Below we highlight two different bank account options for kids available through RBC and how they differ:

1. Leo’s Young Savers

What is it: The RBC Leo’s Young Savers Account is designed to be your child’s first savings account.

Who’s it for: Youth aged 0-12 years

Features: Kids have access to free unlimited Interac e-Transfers and free debit transactions per month. There’s no monthly fee and no minimum balance. Parents can also set up automatic money transfers to their child’s account free of charge.

For more information, visit RBC Leo’s Young Savers Account.

2. Advantage Banking for Students

What is it: RBC’s student account is the next step in financial independence for youth who want more than a standard savings account.

Who’s it for: For students aged 13 years and up.

Features: Earn RBC Rewards points on debit purchases, no monthly fees for full-time students, unlimited debit transactions in Canada, free Interac e-Transfer transactions, no RBC fee to use another bank’s ATM in Canada.

For more information, visit Advantage Banking for Students.

How to open a bank account for your child

1. Gather your personal information

To open an account, you’ll typically need to provide two forms of ID such as:

- Child’s passport

- Child’s SIN (if they have one)

- Birth certificate

- Parent or guardian government-issued photo ID (e.g. health card, driver’s licence, passport)

Usually, the Leo’s Young Savers account can only be opened in person at your nearest RBC branch. However, virtual or phone appointments may be available with financial advisors. To see if virtual appointments are available, call 1-800-769-2561.

2. Visit your local branch

Student and youth accounts can be opened either in your local branch or online. Applications online take about five minutes to complete.

3. Decide which account is right for your kids

Decide which RBC bank account is right for you and involve your kids in the process of opening and operating their very own account. After all, It’s never too early to start helping your kids manage their own money, so they’ll grow into independent, happy money-smart adults.

Alternatives to opening a bank account for a child

If you’re not quite ready to open a bank account for your child, or want more oversight into your kids spending, consider Mydoh.

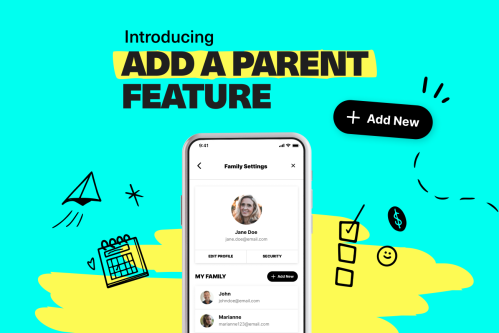

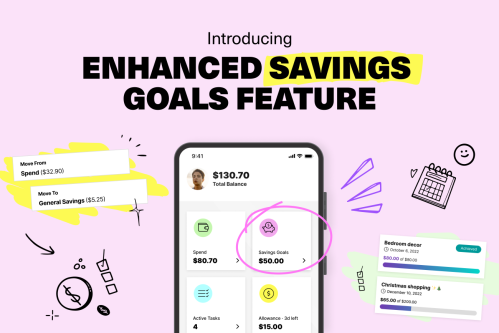

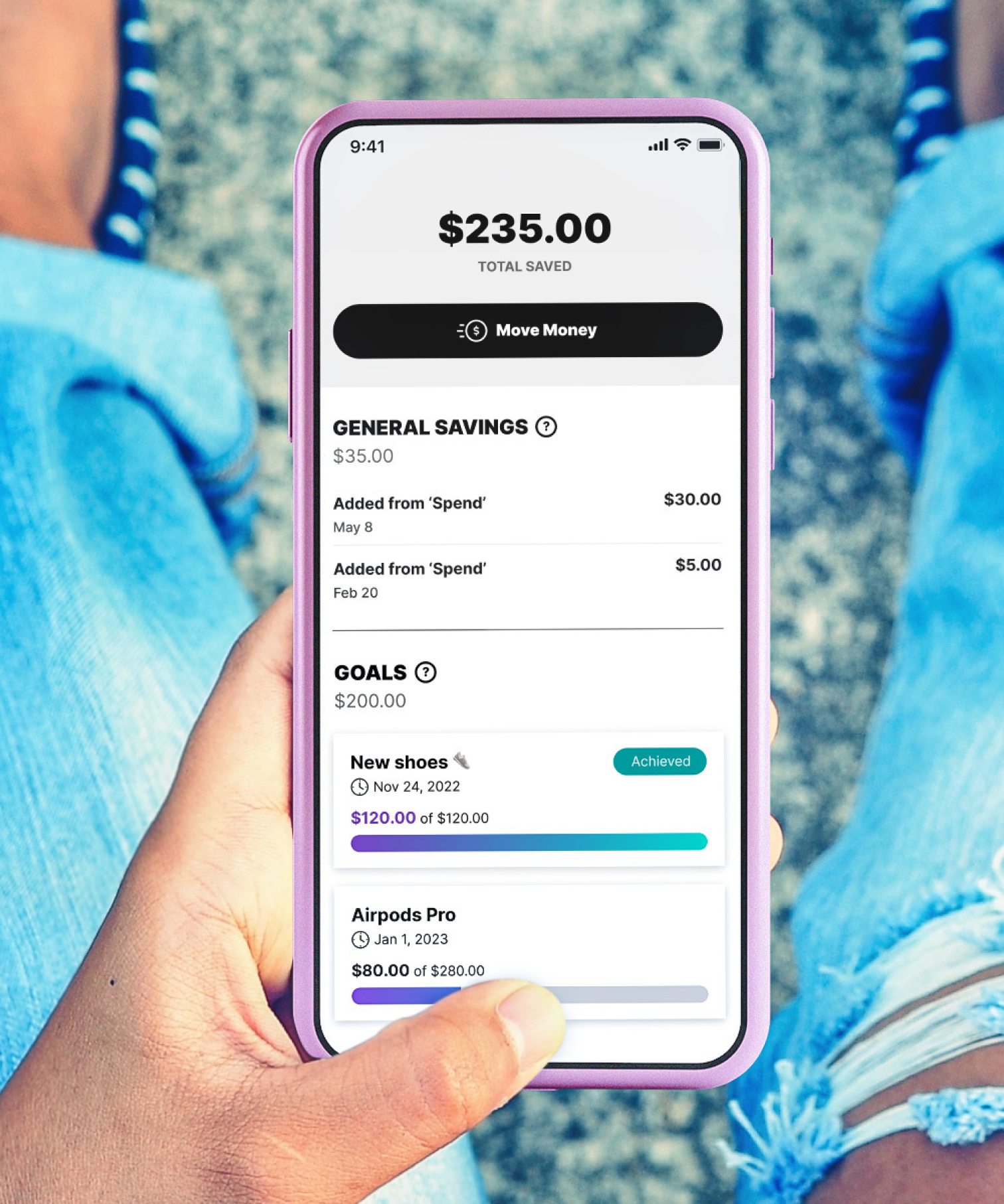

Mydoh is a digital money management app and Smart Cash Card with features to set up allowance and tasks to help kids learn the value of money. Plus, you’ll have insight into your kids’ spending and can react with emojis to encourage smart spending habits. Mydoh can be a great alternative or companion to opening your child’s first bank account.

Download the Mydoh money app and Smart Cash Card for kids

1) RBC Virtual Visa Debits, Third-party payment Debits, RBC Royal Bank loan payments, RBC Royal Bank mortgage payments, pre-authorized and self-serve RBC Royal Bank credit card payments and contributions to RBC investment accounts (such as GICs, Royal Mutual Funds, Registered Savings Plans, Registered Education Savings Plans, Registered Disability Savings Plans and Tax-Free Savings Accounts) from your RBC Day to Day Banking Account, U.S. Personal Account, RBC Leo’s Young Savers Account or RBC Student Banking Account are free of charge. All other Debit Transactions from these Accounts are counted as Debit Transactions towards the free monthly Debit Transactions included in the Account, and give rise to an Excess Debit Transaction Fee if the total free monthly Debit Transactions are exceeded.

2) If you have an eligible banking account and two or more qualifying, eligible RBC products in the same geographic location (region), you may receive a partial or full rebate on your Monthly Fee. Some conditions apply. For more information on the MultiProduct Rebate visit any RBC Royal Bank branch, call 1-800-769-2511 or view the full Disclosures and Agreements Booklet.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.

Teach Your Kids How To Earn, Spend & Save Money

with the Mydoh App &

Add up to five kids and two parents on one account.