Mydoh was created to help parents teach their kids real-world money skills. And now it’s even easier to assist kids in understanding the value of money with our new Add a Parent feature.

“The ability to add a second parent to your child’s Mydoh account at no additional cost was in direct response to listening to our users,” says Rina Whittaker, Chief Product Officer at Mydoh. “It’s a feature that many Mydoh families needed and asked for. Enabling more than one parent or guardian to manage tasks, allowances, and send money, creates additional opportunities to share the responsibility of raising money smart kids.”

By adding a second parent to your child’s account, both parents will also be able to teach kids financial literacy by keeping track of your kids’ spending and goals.

The new Add a Parent feature gives both parents the ability to:

- Add or edit tasks and allowances

- Send money to your kids

- Lock or unlock your child’s Smart Cash Card

- Withdraw money from the shared wallet

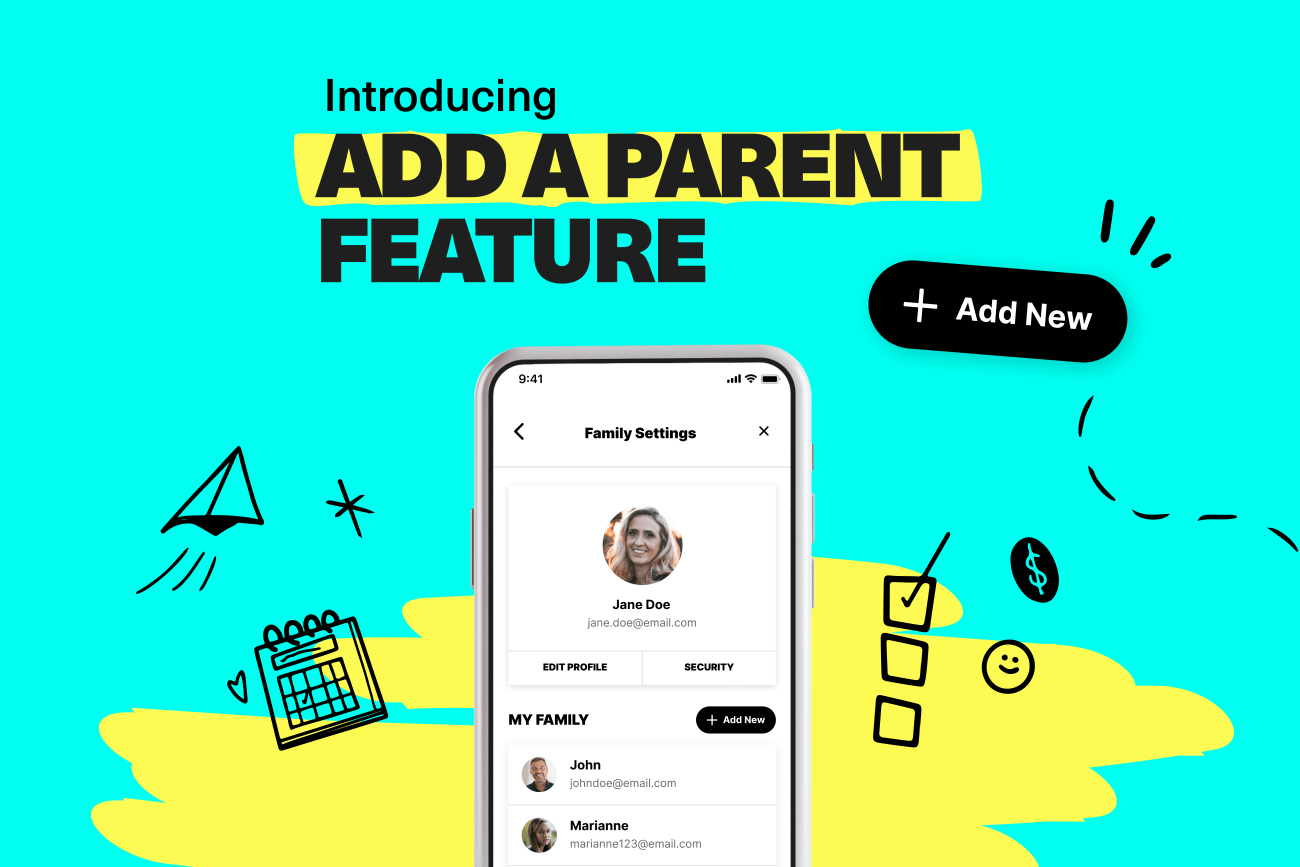

How to Add a Parent or Guardian in the Mydoh app

Adding an additional parent to your child’s account is simple:

- Go to settings in the Mydoh app

- Click on “Family Profile”

- Click “Add New”

- Select “Parent”

- Fill in the required details to add an additional parent

Learn more about raising money-smart kids at home with help from Mydoh. Download Mydoh and help build the foundation of financial literacy for your kids and teenagers.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.