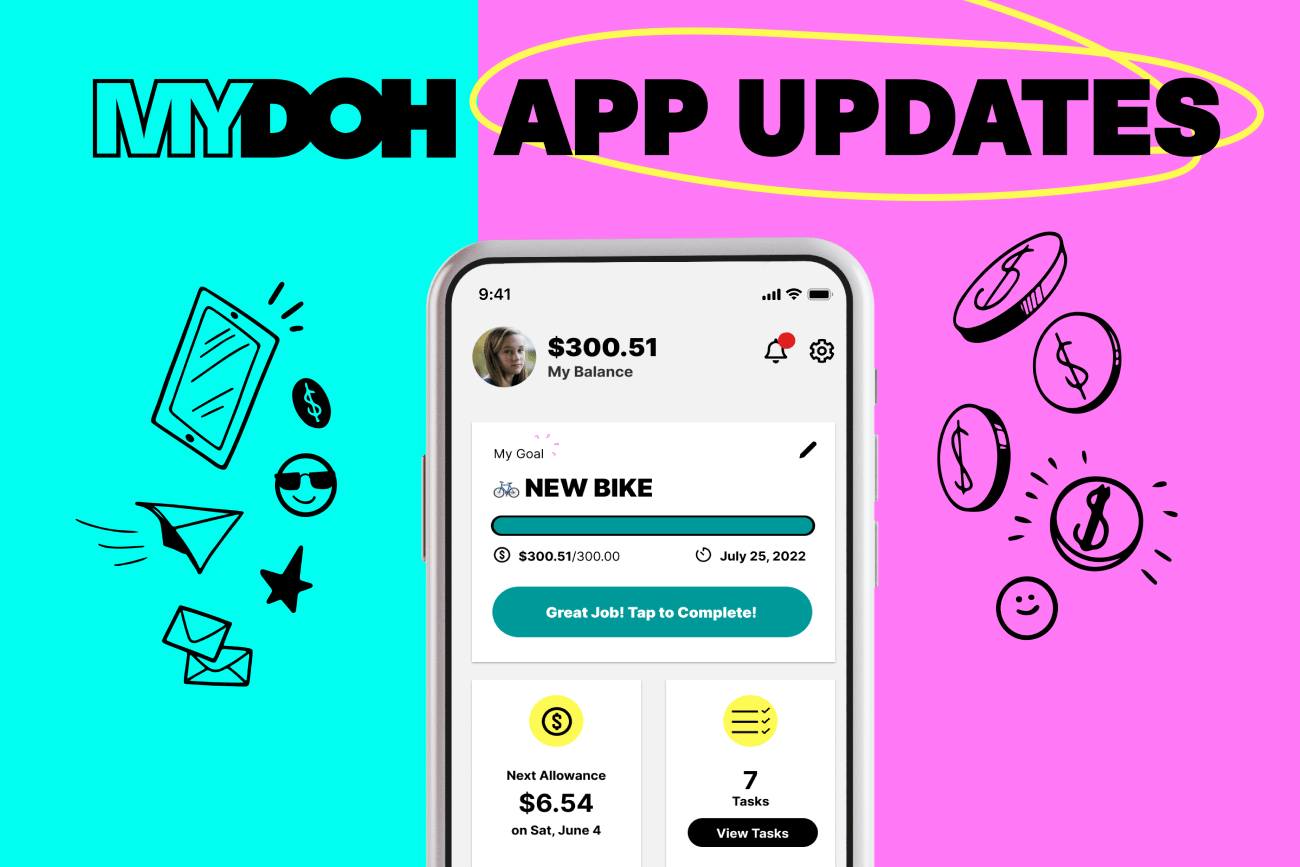

Your child’s first experience with saving money was probably dropping coins into a piggy bank. Learning to save money for a specific goal can give kids a sense of accomplishment and is an important part of financial literacy. To make it even easier for kids and teens to save for that big-ticket item, we added a brand new feature, Mydoh Goals, to our app.

Read on to learn more about how Mydoh Goals can help kids save for the things they want or need!

How Mydoh Goals help kids and teens save

Having the independence to buy the things you want (like a slice of pepperoni pizza or bubble tea) helps kids develop real-world money skills. But, it’s easy to spend impulsively without thinking. Mydoh Goals can help kids and teens visualize longer-term goals, such as saving up for a new computer or bike. By setting a goal, kids have a tangible reason to fight instant gratification and save for something important to them.

As kids earn and save, they can watch their total balance accrue and see how small spending and earning choices can help them reach their goals. Our new Goals feature is also an opportunity for parents to talk to kids and teens about setting SMART goals or their own experiences saving for the future—like putting away money to travel as part of a gap year or for your first car.

How to use Mydoh Goals

Here’s how your kids can save towards their financial goals in the Mydoh app:

Set a goal

Kids and teens can set a goal by choosing the name of their goal and adding an emoji, the category (e.g. trips, electronics, clothing), enter the goal amount, then set a target date to achieve this goal. The Goals feature means kids can set one goal and their overall wallet balance will count towards their goal.

Visually track their progress

Kids can track their progress towards their goal against their current total balance. As their wallet balance counts towards their goal, they’ll be able to track progress whenever there is a change in their balance (like every pay day!).

Celebrate!

When your kids achieve their goal, they’ll receive a celebratory message in the app. This helps reinforce goal-oriented saving and encourages kids to have real-life conversations with their parents about their achievement.

As with other Mydoh features, parents will have visibility of their child’s goal and their progress towards reaching it.

Mydoh wants to hear from you!

Stay tuned for more exciting updates and product features that make it even easier for you to teach your kids about financial literacy. Meanwhile, please contact us by email at hello@mydoh.ca or in-app with your suggestions. We’re listening! We work hard to study all your feedback and transform it into safe and secure features that help you raise money-smart kids.

Download Mydoh to help your kids and teens gain real-life experience managing their money.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.