If you’re a parent to tweens or teens, you probably understand what it feels like to be treated like a walking, talking, bank machine. While handing out $10 here, $20 there seems like no big deal; few of us want to be doing that for our kids when they’re 30 or 40, which is why it’s important to teach our kids to be financially independent.

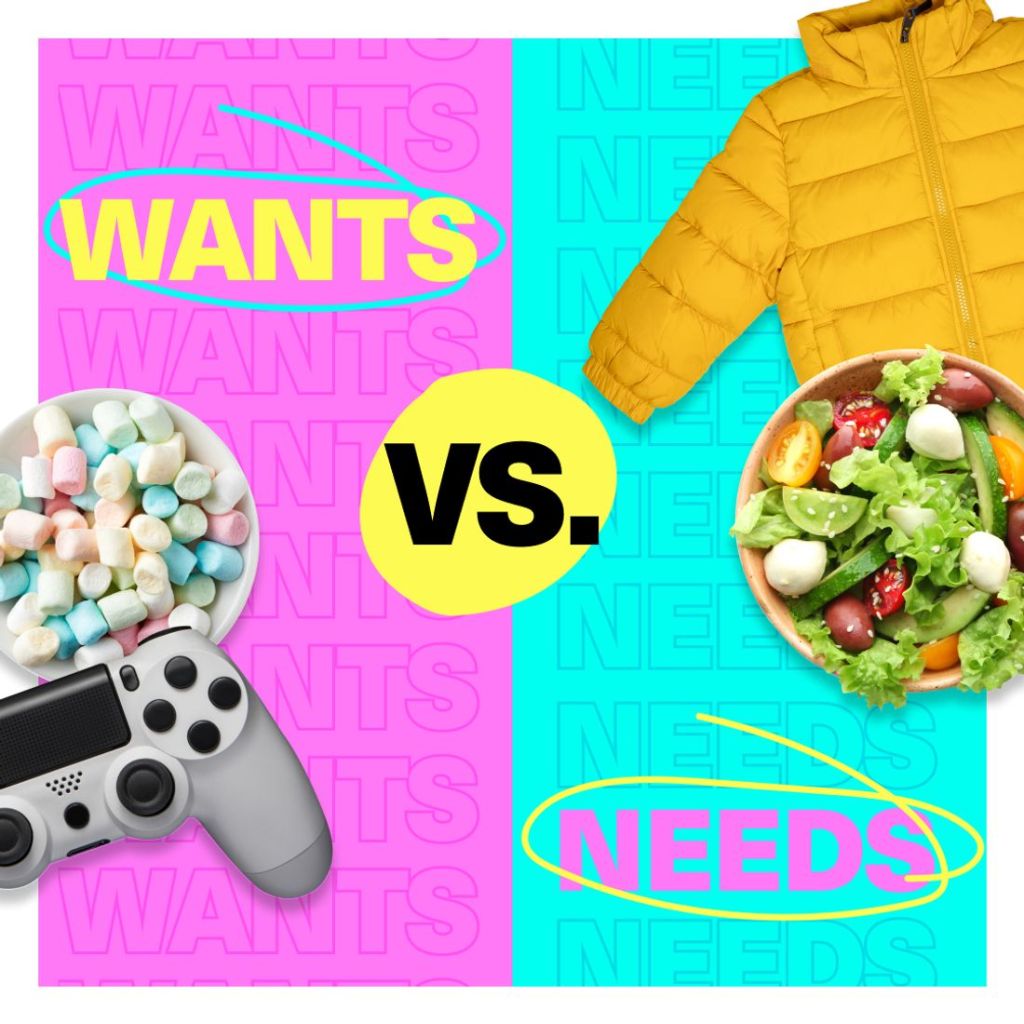

One way parents can help teens and tweens to manage money is by helping them learn the difference between what they want and what they need.

Here are some suggestions on how to do just that.

What is the difference between needs and wants?

Needs are those items that are essential in our day-to-day life. Think of a roof over your head, sufficient food to eat, and clothing. Wants, however, are those nice-to-have items, which might translate into a bedroom with a private ensuite, an extra-large pepperoni pizza, or a pair of High-Tops.

While the fundamental difference between a want and a need is an easy enough concept to grasp, if your teen sees their friends with the newest iPhone or wearing a designer hoodie, they may tell you they “need” one too.

Needs and wants examples for kids

Examples of needs:

- Food

- Water

- Shelter

- Clothing

- Safety

You can explain needs to your child by saying something like:

“Needs are things that are necessary for people to live a healthy and happy life. These include food, shelter, and clothing.”

Examples of wants:

- Travel

- Entertainment

- Video games

- Designer clothing

- Junk food

- Sports car

You can explain wants to your child by saying something like:

“Wants are things that people want but don’t need. They include luxuries such as expensive cars or trips to the Bahamas.”

Why is it important to understand the difference between a need vs. want?

You’ve probably heard of the “marshmallow test.” Pioneered by Stanford University in the 1970s, it set out to study delayed gratification in children. If kids could distinguish between a need vs. something they want, they’ll be able to choose whether they want to delay that immediate gratification (one marshmallow) for a long-term reward (two marshmallows). Only instead of marshmallows or that new computer game, teens can keep their cash in their back pocket and save for a big-ticket item, like helping to pay for their education or buying their first car.

Understanding the difference between a need and a want is also the beginning of building real money skills. As they move into adulthood, tweens and teens can learn how to develop a budget and have the self-discipline to realize that paying the rent is a higher priority than an all-inclusive vacation with friends. They’ll also have the skills and to know how to save for that vacation while still covering their bills.

4 ways to teach the difference between a need vs. a want

Here are four tips on how to teach tweens and teens the difference between a want and a need.

1. Teach them the value of a dollar

At some point, your teen will have grown and flown. One way parents can help prepare them for that day (while also teaching them the difference between a want and a need) is to teach them how to make a budget.

You can even make the task more tangible by breaking out that game of Monopoly that’s gathering dust. Hand your child some Monopoly money and have them allocate it towards each category.

Have your teens see how far their money would go once the necessities are covered.

To make this exercise as real as possible, get teens to flip open their laptops and do some research. What’s the average salary for a 20-something in Canada? (Hint: It’s between $17,000 and $28,400 for a 20 to 24-year-old). Next, have them research how much rent will cost them. What about hydro? Cell phone? Transport? Groceries?

After their costs are spoken for, see how much money is left over. Have a conversation about how they’ve allocated their budget and whether any item on the list is actually a want, not a need.

2. Volunteer

When kids are surrounded by peers who seem to have everything they want, it’s hard to imagine that not everyone is as fortunate. Sadly, there are many families who experience food insecurity.

Read more: The best ways to teach kids about giving.

One way to help your teen learn the difference between what they want and what they actually need is to encourage them to volunteer and give back to others. It could be as simple as organizing a food drive around the neighbourhood. Teens could also volunteer to prepare meals at a shelter or offer to tutor younger kids through a local family charity if they’re academically inclined. If they’re stuck for ideas, the Pan-Canadian Volunteer Matching Platform has thousands of opportunities to give back.

Bonus: Teens who also need to bank volunteer hours as part of their high school curriculum, volunteering serves as double duty.

3. Empower your kids

While parents might take responsibility for certain needs, like haircuts, school supplies, and meals, give your teen the responsibility of paying for their own wants. Let kids cover the cost of those trips to the coffee shop or the latest video game. Not only does this empower them to make their own decisions and have money to spend as they see fit, but it also helps to break the cycle of kids constantly asking the Bank of Mom and Dad for cash.

If your teen already receives an allowance, consider giving them a monthly allowance instead of weekly. That way, they’ll also learn how to budget for what they want over a longer period.

4. Talk about money

If you grew up in a household where talking about finances was taboo, it isn’t always easy to be transparent with kids about money. When teaching teens the difference between a want and a need, start with what they know—or what they think they know.

Encourage tweens and teens to ask questions about finances. Have them reflect on their values. Is this an item they truly want or something all their friends have? If your teen wants a big-ticket item, like a new computer, encourage them to research the best choice for their needs, read product reviews, and compare prices before spending their cash.

Read more: How to avoid kids and teens avoid impulse buying.

How to teach kids wants vs. needs with Mydoh

Using a tool like the Smart Cash Card makes it even easier for teens to save for what they want (and need).

Kids and teens can earn a weekly allowance by completing tasks and then use their Smart Cash Card to make spending decisions independently. Parents have oversight and can facilitate conversions about better spending with their kids at the moment. It’s an excellent opportunity to discuss if a purchase your teen or tween wants to make is, in fact, a want or a need.

Give your kids the financial literacy tools to succeed

Teaching the difference between needs vs. wants is one thing, but putting it into practice is another. Whether you prefer cash or a card, allowing your teen to pay for needs and wants helps empower them to take charge of their finances as they move through life. Best of all, kids can use Mydoh as a way to make those purchases safely and securely.

Download Mydoh to make it easy for your kids and teens to gain real money skills.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.