What a year 2024 has been! We started the year talking about the loud budgeting trend, had a brat summer, took a leaf out of Moo Deng’s book and became ungovernable (but not when it comes to money!), and wrapped it up in our Swifty Era.

Mydoh families achieved some incredible milestones this year too. From earning allowances to crushing savings goals, here’s what kids and teens achieved in 2024!

Take a deeper dive into the 2024 Mydoh year-end review:

Allowance

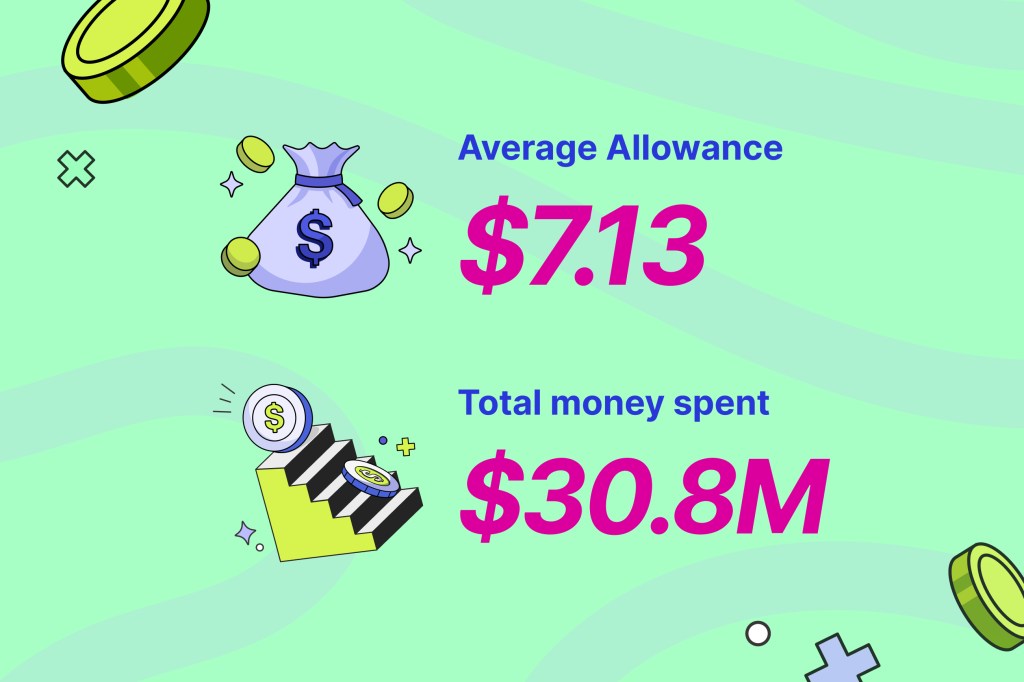

This year, the average allowance for Mydoh kids in 2024 was $7.13 per week.

In the Spring, Mydoh teamed up with Financial Counsellor Jessica Moorhouse to release Mydoh’s first ever Canadian Allowance Report. A weekly allowance is a safe way to start teaching kids about managing their own money.

We learned that 72 per cent of parents say providing an allowance is as important, if not more, than when they were kids. However, 40 per cent of parents also reported that they forgot to give allowances regularly. With Mydoh, it’s easy for parents to automate your kid’s weekly allowance in a few taps and they’ll get paid each Saturday.

Want to learn more about the ABC’s of giving an allowance? Check out our survey and Jessica’s advice to parents in the Canadian Allowance Report.

Spending

In 2024, kids and teens spent a total of $30.8M using their Mydoh Smart Cash Card! (That’s 4,740 gaming consoles, 61,600 hoodies, or 192,500 pizzas!)

This year on the Mydoh blog we wrote about smart spending, including what kids and teens need to know about financial scams and understanding emotional spending.

Savings

Mydoh users were certainly in their Savings Era in 2024. You saved an impressive $4 million! With Savings Goals, kids and teens can save for what mattered most to them.

To help make saving even easier, Mydoh recently introduced Auto-Save and Savings Boost. Now parents can allocate a percentage of their kids’ weekly allowance to General Savings, and supercharge their efforts with Savings Boost! It’s a simple way to celebrate their wins and encourage even bigger savings milestones. Bonus, you earn big aura points.

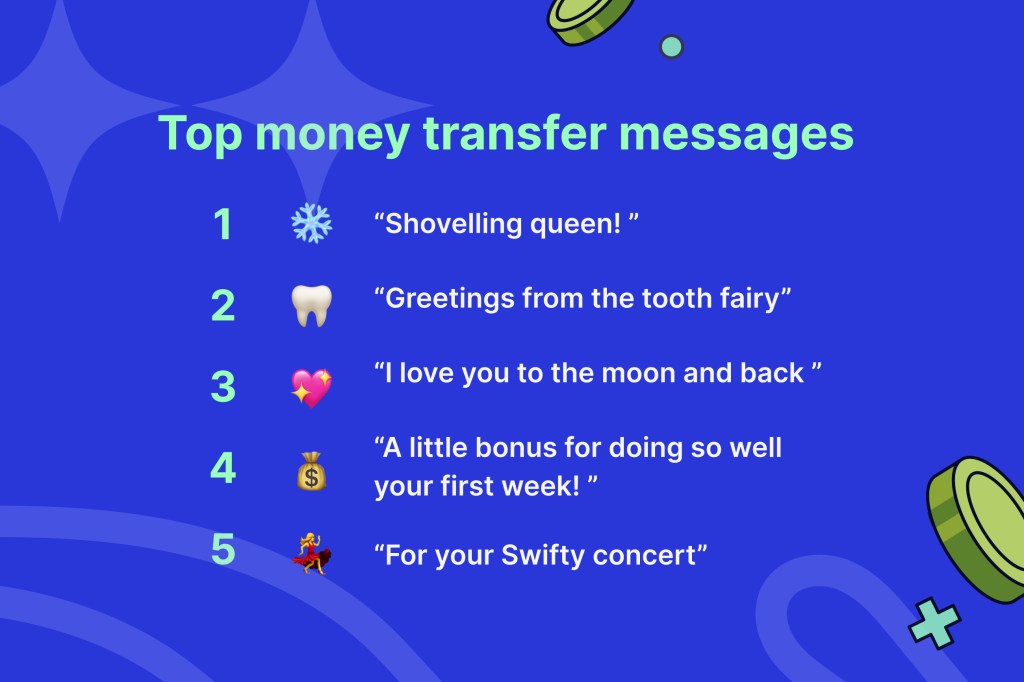

Money transfers

This year Mydoh made it even easier for kids and teens to send and receive money! Now teens aged 14+ can securely send and receive money from friends and siblings who also use Mydoh.

And with payment link, Mydoh kids are now able to receive money from friends and family outside of Mydoh. Perfect for paying kids for odd jobs or sending them a surprise money gift!

Check out how money movement is made easy, free, and secure with Mydoh.

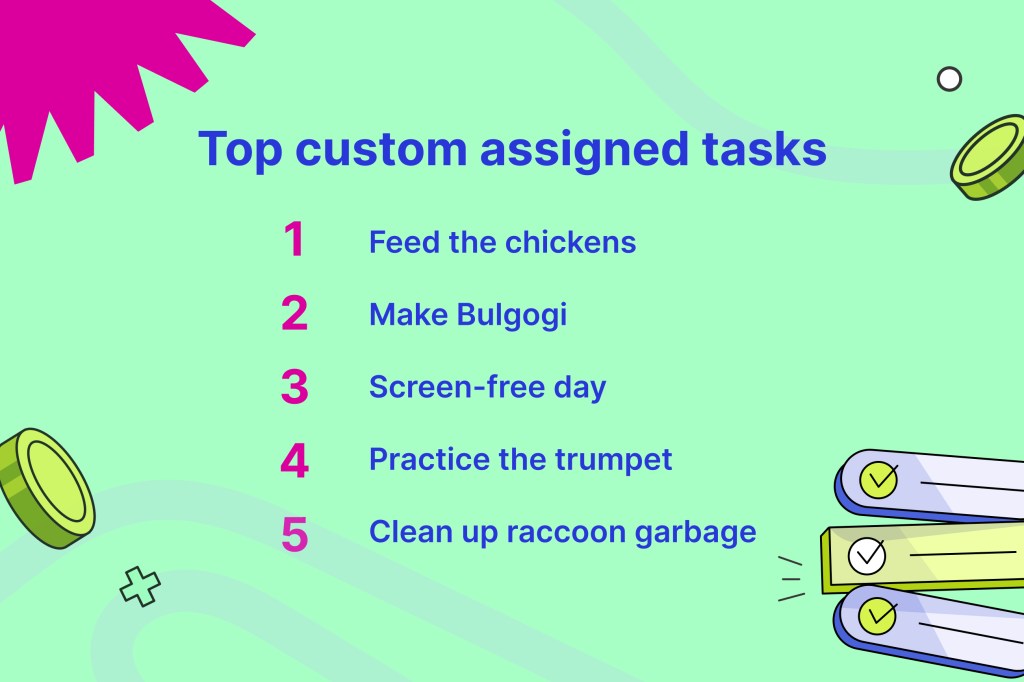

Chores

With Mydoh, you can decide to assign your kids chores, pay for them, or give them an allowance independent of household tasks. Pitching in and doing chores around the house is part of being a family. But not every family is alike – as this list of custom chores shows!

Check out these 10 life skils your kids could learn through chores in 2025!

From earning to spending to saving, kids and teens crushed it in 2024. We can’t wait to see what you’ll accomplish in 2025 🎉

Download Mydoh today and help build the foundation of financial literacy for kids and teenagers this year.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.