So, your tween or teen has their first part-time job? Congrats! They are on their way to building valuable life skills and may even be less likely to beg you for spending money. That’s a win for them, you, and your wallet!

Their new job will also come with a pay stub, which may read like gibberish to a workforce newbie.

That’s where you come in. You’re a valuable resource and can help your teen understand what a pay stub is, how it differs from a paycheque, and how to read it. Don’t worry—we’ll help you nail it. (You also get to tell them about all the deductions that shrink their take-home pay. Break it to them gently!)

Key takeaways

- A pay stub and a paycheque are two separate documents: A pay stub is a record of earnings, while a paycheque is the actual payment of those earnings.

- Paycheques (along with pay stubs) are commonly sent out every two weeks.

- A pay stub will have several key pieces of information, including the pay period, rate of pay, number of hours worked, and deductions.

- Employers are legally required to give their employees a pay stub on or before payday.

- Upon receiving a pay stub, your teen should check the numbers for accuracy—yes, every single time!

- Your kids should also get in the habit of hanging onto their pay stubs for at least six years in case the Canada Revenue Agency (CRA) audits, or reassesses, their tax return.

What is a pay stub?

A pay stub is a record of your wages and includes information like the pay period (a time period between two set dates), their rate of pay (usually dollars per hour), number of hours worked, and deductions, plus any extras such as overtime pay or vacation pay. A pay stub could be either an electronic record or paper record of an employer’s earnings.

Read more about the most important tax terms and definitions for kids.

What’s the difference between a pay stub and a paycheque?

A pay stub is simply a record of a person’s earnings, while a paycheque is the actual payment of the amount they’re owed. Here are two ways teens might get paid:

- By cheque: Your teen could receive their paycheque in the mail with their pay stub attached or it could be handed to them directly by their employer. They’ll need to deposit the cheque into their bank account and hang onto the pay stub for their records.

- By direct deposit: If they’ve signed up for direct deposit with their employer, their earnings will be deposited right into their bank account and they’ll likely get a pay stub by email.

How often should you get a paycheque?

Most employers send out paycheques biweekly, which means every two weeks. Your teen should receive their cheque or direct deposit on the same day (say, Thursday) every second week. Other employers may send out payments once a week, once a month, or semi-monthly (meaning always on the 15th and 30th of the month, for example).

If your teen does odd jobs, contract work, or has a short-term summer job, their paycheques and pay stubs may arrive at irregular times. In these cases, they should be given something in writing by their employer before they start work that outlines their pay periods and paydays.

Read more: The best part-time jobs for teens

How to read a pay stub

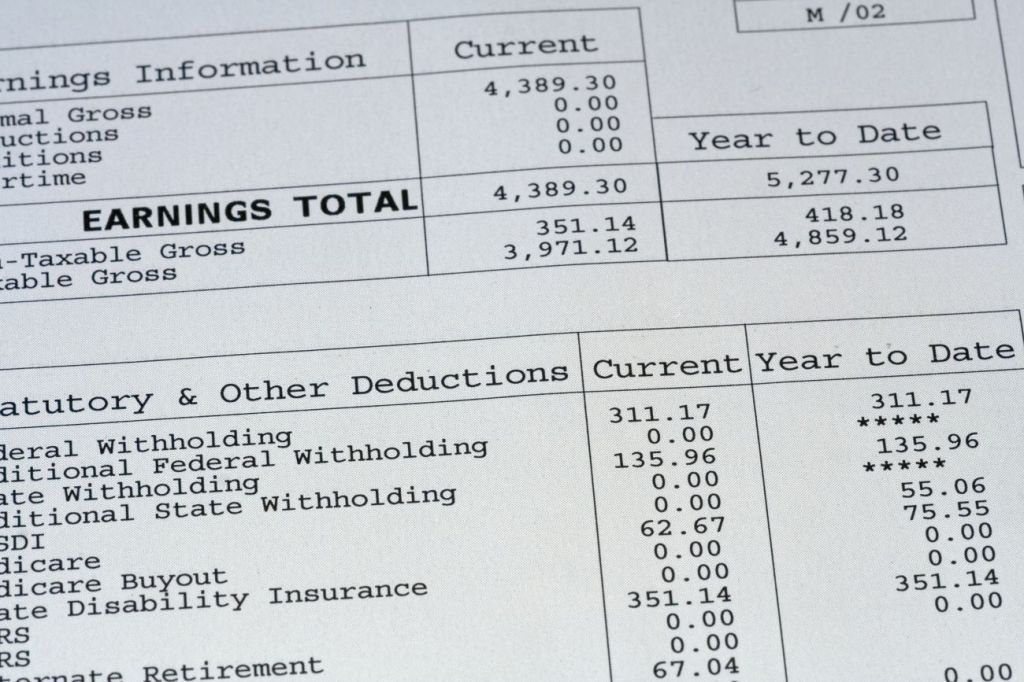

There’s no standard format for pay stubs—each employer makes their own. But here are some standard sections and terms for pay stubs in Canada:

- Pay period: A pay stub should note the date range of the paycheque, including the first and last day of the payment period.

- Year to date (YTD): This section shows the total pay and deductions from the beginning of the year through the current pay period.

- Social insurance number (SIN): Every nine-digit SIN is unique to an individual and is required for someone to work or access government benefits (like employment insurance, often referred to as EI, in case of job loss). It’s illegal for anyone to use a SIN that’s not their own. Your teen’s SIN may or may not appear on their pay stub.

- Rate of pay: The hourly rate should be listed on the pay stub. There may be more than one rate if there is a regular rate of pay and one that’s used for overtime (OT) hours or hours worked on holidays.

- Number of hours worked: A pay stub should include the number of hours worked during the pay period. If your teen worked some regular hours and some overtime (OT) hours, each number should be listed separately.

- Gross pay: The gross pay is the total amount of pay before deductions have been removed.

- Net pay: The net pay is the “take-home pay,” or “after-tax amount,” which is the total amount your teen gets to keep after deductions have been taken off.

- Deductions: There is a range of tax deductions that an employer can take from a paycheque, and they should all be listed on the pay stub.

Here are some examples of deductions:

- Canada Pension Plan (CPP) or Québec Pension Plan (QPP), which is 5.7 per cent and 5.4 per cent of the gross income, respectively. The employer will also match their employee’s CPP/QPP contributions.

- Employment insurance (EI), which is a percentage of the gross income that the employee and employer will pay to the government. EI can help with income loss in the case of a layoff in the future.

- Provincial and federal taxes.

- Health insurance premiums, if applicable.

- Union dues, if applicable.

Are employers required to give you a pay stub?

Yes, by law, an employer must give you a pay stub on or before payday. This pay stub must include the following info:

- The rate(s) of pay, typically in dollars per hour for teens

- The pay-period dates

- How many hours your teen worked at each rate of pay

- The total wages for that period, before and after deductions

- The amount and reason for any deductions

Employers are not allowed to deduct money for a mistake, such as dropped dishes or broken equipment.

Why does your pay stub matter?

Receiving a paycheque is awesome because it means your teen can buy some of the things they want and hopefully save some money for the future. But receiving regular paycheques is also a responsibility, especially as they go through life and their income increases. Here are a few reasons why they’ll want to check their paycheques and pay stubs when they get them and why they should keep their pay stubs somewhere safe.

- To check total hours: If your teen works the exact same hours every week and receives the same payment every two weeks, they’ll know pretty quickly if they haven’t been paid accurately. But if they work part-time hours that change from week to week, they’ll want to make sure that they receive the correct payment each time. You can encourage your teen to keep track of their shifts on their phone or in a planner so they can cross-reference.

- To ensure their paycheque matches: The pay stub and paycheque for each pay period should match. Your teen should check to make sure they do—or that the amount they receive in their bank account is the same as the net pay written on their pay stub.

- To pay income tax: If your teen makes more than the minimum taxable amount in a given year ($15,000 in 2023), then they’re on the hook for filing a tax return and paying their provincial and federal income taxes. They will also need to file a tax return if they want to potentially receive a refund on deductions that were taken off their paycheques.

How long should you keep your pay stubs?

The Canada Revenue Agency (CRA) manages the tax documents of Canadians and Canadian businesses. If your teen files a tax return, they’ll pay any taxes owed directly to the CRA or they’ll receive any refunds they’re entitled to. Since the CRA can request proof that a tax return is accurate within a few years after filing, they recommend that Canadians keep their records, including pay stubs, for six years.

- For electronic pay stubs: Encourage your teen to create a file on their computer for all their pay stubs and organize them by year.

- For paper pay stubs: Either set up a physical filing system (maybe parents can give up a filing drawer in the home office) or use a scanner or scanning app to turn paper pay stubs into electronic files to sort by year.

A teachable moment

Receiving that first pay stub, with all its columns and abbreviations, may feel overwhelming for a teen who’s new to the workforce. By sharing this information with them—from how to read a pay stub properly to the importance of keeping records—you’re helping to set them up with practical money skills for a more secure financial future.

The Mydoh app can help, too. Not only does it teach the basics of money management for kids and teens, but it can also help them track their earning and spending, complete tasks that you set for a bit of extra income, and even spend money within limits on their Smart Cash Card.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.