Sparking a conversation with your kids about the value of a dollar is a great first step in teaching practical money skills. Going a step further to explain where people park their hard-earned cash? That takes teaching kids about money to a new level—good on you!

If your teen or child is eager to open their first chequing account or simply curious about the local credit union in your neighbourhood, it might be a good time to talk about their two options for retail banking in Canada: credit unions and banks.

Most of us are familiar with traditional banks, so you’re not alone if your kids ask “What is a credit union?” and you don’t have an answer ready to go. Fear not: After reading our guide on the difference between banks and credit unions, you’ll have all the answers to your kids’ questions at your fingertips!

Key takeaways

- Both banks and credit unions are dedicated to helping people with their financial needs.

- Credit unions by definition are financial co-operatives. They are owned and run by their members. Often members have to live in a specific region or be a member of a certain community.

- Banks have customers instead of members. They can serve anyone across Canada.

- The main difference between a credit union and a bank is that a credit union is non-profit, while a bank is a for-profit financial institution.

- Banks and credit unions offer many of the same services, but banks are more likely to offer a broader range of services and products.

- Credit unions are as safe as banks. Credit unions follow the laws in the Credit Unions Act and are insured by the provinces.

- Banks are insured by the Canada Deposit Insurance Corporation (CDIC).

Banks versus credit unions

It’s not surprising that most kids—and more than a few adults—aren’t familiar with the difference between the two types of financial institutions. In 2021, only about six million Canadians used credit unions for personal banking. By comparison, RBC (Royal Bank of Canada) is one of Canada’s Big Five banks and has about 17 million clients.

But life as we know it today wouldn’t be possible without credit unions and banks. They’re both dedicated to helping Canadians with important financial needs, such as chequing and savings accounts, investments, credit cards, mortgages, and more.

What’s the difference between a bank and a credit union?

The main difference between credit unions and banks in Canada is that banks are for-profit organizations while credit unions are not-for-profit.

As for-profit institutions, banks earn money for their shareholders and investors—people who buy part of the company and get to make money from its profits.

Credit unions want to earn money for their shareholders, too, but with one big difference: Only members—the correct term for credit union customers—can own shares. You have to buy a share before you can access the credit union’s services. That’s why credit unions are not listed on stock exchanges. Credit unions return the profits they earn to their members through profit-sharing, lower fees, community investments, and surcharge-free ATMs.

It’s important to note that a credit union can’t call itself a bank. In fact, it’s illegal. In 2017, the Canadian federal government asked all credit unions to remove references to “bank,” “banking,” and “banker” from their websites and advertisements.

Now that you have a general overview of what the two institutions do, let’s dive into the nitty-gritty details that separate them.

What is a credit union?

Credit unions are similar to banks in that they provide all the same services you’d expect from banks, but only credit union members can access them.

Credit unions by definition are financial co-operatives. This means that they’re owned and run by members—the people who deposit their money into them. Credit unions are unlikely to provide guidance or products to anyone that doesn’t belong directly to the community they serve. A community might exist around a geographic location, an employer, a place of worship, or even a school.

What is a bank?

Banks, alternatively, serve customers instead of members. They can help anyone Canada-wide, from the Yukon to Prince Edward Island and anywhere in-between. Banks not only keep deposits safe and distribute loans among people, businesses, and even government organizations but they also act as a tool for the Bank of Canada.

If the Bank of Canada wants to boost the economy, it will lower the amount of money a bank must keep in reserve (or money they cannot lend out). This frees banks to offer up more loans, which leads to increased investing and business growth and more personal spending.

Conversely, if the Bank of Canada wanted to tighten the economy, it would increase the amount of money a bank must have on reserve. This makes it harder for organizations, businesses, and people to borrow money, which then slows down spending.

Who owns banks vs credit unions?

Both types of institutions are owned by shareholders. As we’ve already covered, being a customer at a bank doesn’t automatically make you a shareholder. To join a credit union, though, you do in fact have to buy a certain amount of shares first. The price of a share is set by the union’s bylaws, and it usually ranges from $1 to $25.

Anyone in the world can buy a share of a big Canadian bank. Most shareholders aren’t consulted about how a bank should be run. To have influence, you would probably have to own a lot of shares in a bank.

Who can join a credit union?

To be a member of a credit union, you need to be part of the community that the branch serves, such as by living in a certain city or being a teacher there. Credit unions also actively invite members to run to join the board of directors as volunteers. If they don’t want to be a director, members can attend their credit union’s annual general meeting, where they can vote on how the business is run. Membership is bound by the community, and having fewer shareholders means your voice is more likely to be heard.

Do banks offer more services than credit unions?

Banks and credit unions offer many of the same services, but when it comes to selection, banks are in a different ballpark.

Since banks have a wider, more diverse array of customers, they need a variety of products to meet each customer’s individual needs. They also have more resources to come up with new and unique offerings. Many customers appreciate having as much choice as possible, so they turn to banks.

While credit unions have less on the menu when it comes to products, some people might like a tighter selection of options.

Do banks or credit unions have better interest rates?

The Canadian Bankers Association defines interest as “the cost of money” and interest rates as “the cost of using someone else’s money.”

When Canadians want to take out a mortgage or other kind of loan, they tend to seek out the lowest interest rate possible in order to pay back the least amount of interest. But when people want to earn money on the cash they keep at a bank or credit union, they tend to prefer accounts that offer higher interest rates.

It’s worthwhile to compare the different interest rates among banks and credit unions. Keep in mind that while interest rates may or may not differ, credit unions try to repay their shareholders (or members) through profit-sharing. A little math and research will tell you where your money is best kept—and where might be better to borrow from.

An important thing to remember is that interest rates aren’t set in stone, even at a major bank. And if you’re looking to borrow money and find that interest rates are too high, you can always ask if they can offer you a better rate. This may be especially true if you’ve been at the same bank for years, have an excellent credit score, and are serious about moving more (or all) of your banking needs to them.

Are fees higher at credit unions or banks?

Both credit unions and banks sometimes charge fees for maintaining a bank account, making a certain number of withdrawals, sending money to others, going into overdraft, and more.

Credit unions have a reputation for offering lower fees. For instance, they may not charge you monthly for having a chequing account. Credit unions are also part of THE EXCHANGE Network, which means you can withdraw money from any other credit union’s ATM without being charged a fee.

Keep in mind that fees are always changing. It’s best to compare them directly between the banks and credit unions that you’re most interested in.

Luckily, kids and teens don’t have to worry about banking fees just yet. Many financial institutions don’t charge fees on youth or student bank accounts.

Which one has better online services and technology?

Banks tend to be more innovative when it comes to online services, technology, and their overall digital presence. That’s because banks have the ability to pour more of their resources into improving their online banking experience, which is important when serving customers all over the country. Banks want to ensure that their websites and apps are secure and easy to use, and have an up-to-date design.

Plus, banks are always trying to stay on top of the changing needs of their customers. For instance, banks now offer budgeting and tracking tools—like the Mydoh app—to help kids and parents better understand their finances and reach their goals.

Canadian credit unions are catching up, though. Apps for Android and iPhone are now available at many credit unions, allowing members to check their balances, make e-transfers, and pay bills. Some offer the ability to add Interac cards to digital wallets.

As more and more of our daily tasks move online, it’s safe to assume that credit unions’ digital services will also continue to improve. But if you want a cutting-edge digital experience right now, your best bet is to open an account with a major bank.

Is a credit union as safe as a bank?

In short, yes. Credit unions follow the laws set out in the Credit Unions Act (each province and territory has its own version of the act) and are overseen by regulatory bodies that administer the law.

And, just like with banks, the money that members deposit into their local credit union is insured, meaning if the credit union goes out of business for some reason, members’ money is guaranteed by deposit protection.

Banks are insured by The Canada Deposit Insurance Corporation (CDIC), a federal organization that insures eligible deposits separately for up to $100,000.

Credit unions, alternatively, are insured by the provinces. To see how much coverage is available in your province, you would need to check with the regulatory body for your region or inquire with the credit union directly.

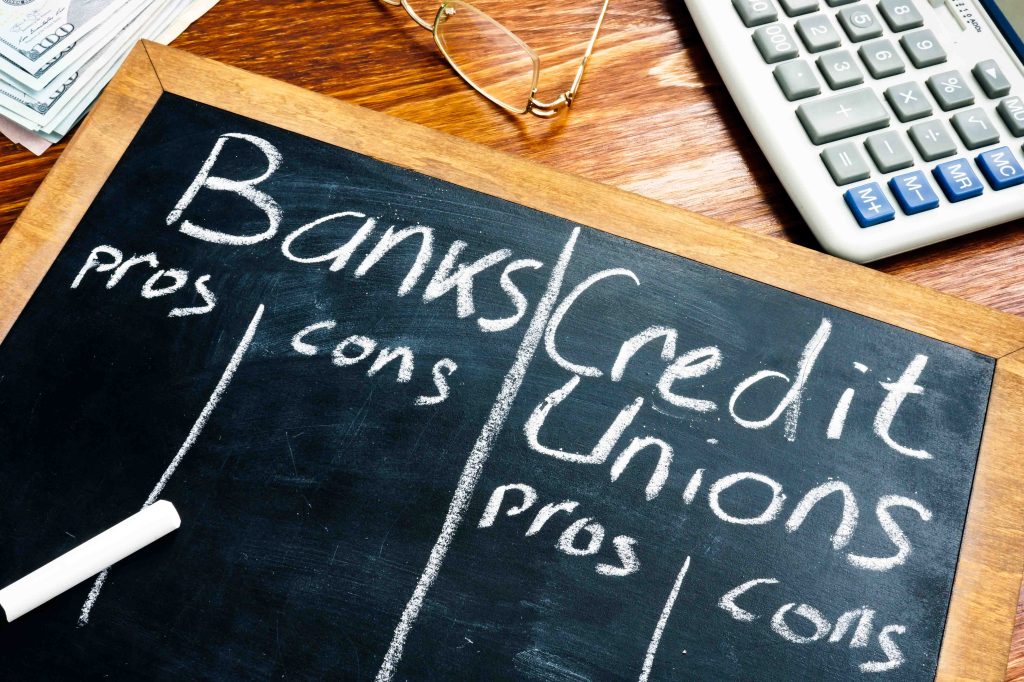

Key differences between banks versus credit unions

Here are the advantages and disadvantages between a traditional bank and a credit union, broken down by pros and cons:

What are the pros and cons of credit unions?

Pros:

- You can often use ATMs from competing credit unions at no charge

- Lower fees and competitive rates

- More likely to work with people with poor credit

- A human touch and strong customer-service track record

Cons:

- Fewer physical locations

- Not as technologically advanced

- Limited product selection compared to banks

- You have to meet eligibility requirements to access the credit union’s services and buy a share to join the company

What are the pros and cons of banks?

Pros:

- You don’t need to be a member to use the bank nor live within a certain geographical location

- More financial products to choose from, such as deposit accounts, investment funds, and credit cards

- Excellent online services and easy-to-use websites and apps

- Digital banks offer no-fee banking

Cons:

- Slightly higher fees compared to credit unions

- The bank is run by a corporate board, so you don’t have a say in how the bank runs its operations

- Less of a “personal touch” if you rely solely on digital services

Is it better to have a bank or credit union?

Banks and credit unions are both great choices, and it’s possible to try out both. Everyone values different things in a financial institution, so deciding which to go with is a deeply personal decision.

If your kid or teen is tech-savvy and dreaming of becoming an app designer or entrepreneur, they may be more drawn to banks that offer an awesome mobile-banking experience. Other kids are more civic-minded and may find that their values align with a credit union’s commitment to their local community.

Talking about the difference between credit unions and banks can be a starting point for valuable conversations, especially those about money management for kids.

Invite teens to think about their values and goals: Which path is more likely to help them achieve the life they imagine for themselves?

A great way to introduce your kids to banking and credit unions

If you’re looking for a way to introduce your kids to earning and saving money, consider the Mydoh digital wallet and Smart Cash Card. With Mydoh, your kids can earn their own money through our allowance and chore tracker, and spend it wisely using their Smart Cash Card. And, it all starts from your Parent Account.

Download the Mydoh app today and give your teens the opportunity to learn about money and save for the future, with the help of a safe and secure digital wallet!

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.