For some of us, learning how to save money is a lifelong challenge. It’s often more fun to buy something you want now than save for a future expense. Teaching your teen or tween the merits of saving money, therefore, can feel like work for both of you. But it doesn’t have to be that way. Your teen or tween can make saving money fun using gamification.

With the techniques below, you can turn saving money into a game and help your teen or kid develop money saving habits without it feeling like a chore.

What does gamification mean?

Gamification is a method that uses challenges, competitions and rewards to motivate certain behaviours or teach lessons. It can be achieved through digital apps, as well as with real life exercises. By gamifying savings efforts, learning about money can be a positive experience for kids, rather than a stressful one.

Can gamification improve kids’ financial behaviour?

One benefit of gamification is that it can shift the brain from “work” mode to a more relaxed and receptive state, otherwise known as flow. Rather than feeling overwhelmed or coerced, learning is fun and engaging. When you turn saving money into a game, the process of saving and setting goals could be more interesting, and rewards can be set up to reinforce good choices. While there are a number of digital apps that can help you gamify money management, including Mydoh, there are also analogue techniques that kids and teens can use.

4 simple ways to gamify saving money for kids

Here are four simple ways to incorporate game elements to help your teen or tween develop the habit of saving money.

1. Set a savings goal

Talk to your teen or tween about what they want to save for. For a teen, that might be college or university funds or perhaps even a car. A younger tween may want to save up for a video game console. Determine a specific dollar amount they need to reach so that they have an end goal.

Tip: Use Mydoh’s savings calculator for kids to create a plan for how long it’ll take to reach their goal!

2. Set up rewards

For some, watching a savings account grow is not all that gratifying. That’s why it helps to break the main goal into smaller milestones that unlock rewards to keep your tween or teen motivated.

One popular tactic is known as the savings “ladder.” You can create one by dividing your kid’s major savings goal into smaller amounts or “rungs” on the ladder. Every time a rung is reached, there is a reward. For example, if the major goal is to save $500, the rungs can be set at $100 intervals: $100, $200, $300, $400, and finally $500.Decide in advance what the reward should be.

Here are some ideas:

- A weekend free of chores

- A small purchase using some savings

- Movie night

- Take out food of their choice

3. Track progress

One way to keep kids engaged and excited about saving is to make their progress visual. Hang up a whiteboard to keep track of the increasing savings, or use a fun printable that your kid can update on their own.

Your tween or teen may also want to try the 50 envelope challenge (based on the original 100 envelope challenge popularized on TikTok). Write a dollar amount on each envelope starting at $1 up to $50. Every week, select an envelope at random and fill it with the cash amount indicated. After 50 weeks, your teens’ total savings will reach $1275!

4. Friendly competition

This can be a great motivator for saving money if your teen or tween has a competitive spirit. One option is to compete against time. Challenge your child to reach a savings goal by a particular date; offer a top up “bonus” if it’s accomplished.

Alternatively, engage the entire family by setting up a “no spend” week or month in which every member of the household vows to cut out one spending habit, such as eating out at lunch or buying coffee every morning. Cheer each other on and hold one another accountable. You can even track when you say “no” to the purchase and add up the savings over time.

Learn more: How to help kids and teens avoid impulse buying.

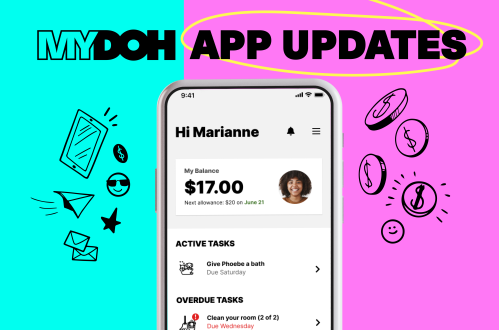

How Mydoh can gamify money management for kids

Mydoh is an app that teaches tweens and teens about saving, budgeting and money basics. As a parent, you can set up weekly allowances, as well as assign specific chores that can earn kids extra cash or rewards outside of their allowance. Celebrate their good financial choices and completed tasks with emojis. Thanks to the Smart Cash Card and the ability to send money instantly, kids enjoy immediate rewards for their actions. Mydoh uses real life rewards and gamification techniques to help make teaching money management to kids enjoyable.

Learning how to save money doesn’t have to be boring or difficult for kids.

Download Mydoh and get started today.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.

Teach Your Kids How To Earn, Spend & Save Money

with the Mydoh App &

Add up to five kids and two parents on one account.