It feels like everyone’s been asking the same question lately: are we in a recession? Canada’s recession status has been all over the news, social media and in conversations. Maybe your kids have started asking questions or noticed your shopping habits have changed.

So, what does a recession mean for Canada? It’s not an easy conversation to have but proactively teaching your kids about a recession, and ways to stay resilient through one, can help them understand what’s happening and feel in control during uncertain times.

Here’s how to talk to your kids and teens about a recession.

What is a recession?

Economic growth requires a healthy balance of factors like interest rates, inflation, consumer spending, and employment. A recession is triggered by a decrease in economic growth over a prolonged period, specifically two or more consecutive quarters (or six months) of negative growth.

Economists use different methods to track this growth, but Canada’s real Gross Domestic Product (GDP) is the most common. It measures the value of products produced here within Canada minus the effects of inflation. Just as doctors measure a child’s growth at annual check-ups, the GDP is measured quarterly and is used to track how healthy the economy is. If growth keeps dropping, the economy could enter a recession.

Is Canada in a recession?

As of January 2024, Canada is not technically in a recession. However, there are many reasons why economists have been anticipating one, such as high inflation and high-interest rates. How long do recessions last? Luckily, right now economists are predicting a fairly “mild” recession, meaning Canada’s economy could recover from it this year. What happens in a recession in Canada determines how quickly it recovers, such as market adjustments and stimulus programs.

What factors cause a recession?

While the following list is not definitive, here are some of the most common factors that can cause a recession in Canada:

High interest rates

Interest rates, the amount charged on top of a loan, were low at the beginning of the COVID-19 pandemic. This helped drive consumer spending. The Bank of Canada raised interest rates in an effort to cool the overheated market. Monthly payments may be higher versus when interest rates were low. People may cut back on their spending or stop buying other things to make up the difference. If people can no longer afford their loan payments, it could damage their credit ratings and even lead to bankruptcy.

Loss of consumer confidence

A healthy economy requires people to feel confident spending and investing in products and services. Yet higher interest rates and less purchasing power means people can’t spend as much as they did before. Consumer Confidence in Canada is measured on a regular basis, and declining consumer hesitancy around spending and investing can help predict a coming Canadian recession.

Inflation

Inflation is the rate of which prices go up and down. When there’s a lot of demand for something or it’s harder to get, like real estate and certain household goods, prices go up. When there’s less demand, prices go down. Inflation itself is normal and the Bank of Canada tries to keep it around two per cent. But when there’s a dramatic rise in inflation and people’s incomes remain the same or drop, it impacts the economy. People’s expenses rise but their paycheque can’t stretch as far, so they spend less or take on new debt.

Try to explain the nuances of inflation to kids by using examples they relate to, like the prices of their favourite food or video games and what they would cost with inflation. Ask them to multiply those extra costs by how often they make purchases. StatsCan inflation charts can help to illustrate the rising costs, such as the inflation Canada chart showing rising grocery costs.

Deflation

Deflation is when inflation rates decline significantly. It sounds like a good thing but it can also have a negative effect on the economy. The Bank of Canada says deflation can lead to lower production and wages. It’s relatively rare in Canada, with the last period of sustained deflation during the Great Depression in the 1930s.

Stock market crash

The stock market is constantly in flux but a sudden and significant drop can trigger what’s called a stock market crash. People buy, sell and trade stocks (shares) of public companies hoping to get in at a low price and profit by selling when the values are higher. During a recession, when life is more expensive and the economic outlook bleak, people may decide to sell their stocks. Panic selling, when many people do this at the same time, could trigger a crash. While it’s rare, stock market crashes have happened when an industry declines quickly or another event causes people to pull back their investments.

Asset bubble burst

Sometimes people get captivated by a product or trend and demand for it surges, causing a “bubble.” It could be a new technology like cryptocurrency, or a seemingly-random event like what happened with some stocks getting extra attention thanks to a Reddit post. Or, a real estate bubble where the price of homes suddenly far exceeds what is considered reasonable. If something happens to suddenly cause a drop in demand or value, it can cause that asset bubble to “burst.” People who bought when the price was high can lose a significant amount of money.

Credit crunch

A credit crunch happens when there’s a sudden decline in lending and credit. This can happen for several reasons, like a shortage of available credit or funds, regulatory pressure, or banks being more hesitant to lend, even to people with good credit. For example, if banks have lent out a lot of money but it’s getting harder to recoup those loans, or they’re worried about bankruptcies, it may result in a credit crunch.

Supply chain challenges

The pandemic lockdowns and illnesses caused unprecedented supply chain issues across many industries. Some products and parts became harder to get, shipping times unpredictable, and workplaces short-staffed or shut down. It can now cost companies more to make and transport products or keep in stock, which raised price tags and made prices unpredictable. A December report by Canadian Black Book found that a shortage of new cars led to the average cost of a used car increasing by almost 50 per cent in one year.

How can a recession affect Canadian families?

A recession impacts families in different ways, depending on their situations. Here are a few ways your family could be affected:

Goods and services cost more

Almost everything we buy costs more these days, from clothing to groceries. According to RBC economists, higher prices and interest rates will result in the average household’s purchasing power dropping by $3,000. With life getting more expensive, families may have to be careful about how they spend and cut back where they can. Talk to your teens about their spending habits and if they’ve noticed a change in what they can afford.

Job loss or pay cut

During a recession, employers may look for ways to save money. Some cut back on raises or reduce their budgets. Others may need to eliminate jobs. If companies do hire, salaries and wages could be lower. If your teens are working now, they may find themselves with fewer shifts or making less money. Let them know that employment rates fluctuate just like the economy, and assure them it will bounce back eventually.

Harder for recent graduates to find a job

Employment freezes or cutbacks can have a big impact on recent college grads, too. Companies may choose to hire more experienced people which makes it harder for grads to get a foot in the door. Assure your kids that this too will pass. Discuss ways to weather the storm, like using the downtime to volunteer and gain new skills.

Housing may become more expensive

High-interest rates mean it’s more expensive to buy a home, especially for those with a variable mortgage. Rising costs of construction materials, repairs and household services can also make it more expensive. With fewer people looking to buy a home, there’s more demand on the rental market, and some parts of Canada are seeing rent increases reaching record highs. This can be especially tough for people on fixed incomes, like students and seniors. If your teen is preparing to live on their own, check the market in their area and help them set realistic expectations. Explore options like taking on a roommate, reducing their costs of living or finding a place within walking distance, so they won’t need a car.

Cost of borrowing increases

High-interest rates mean it costs more to borrow money. If your teen is planning on taking out a car loan or investing in another big-ticket item, talk to them about whether it’s urgent. Help them do the math to see how much they could save on their monthly payments if they wait for a lower interest rate.

Investments may be unpredictable

Some people choose not to invest during a recession when markets are unpredictable. Others see it as an opportunity to get into the stock market when prices are low. It comes down to your personal risk tolerance. Talk to kids about their own risk tolerance and discuss the pros and cons of each.

How families can prepare for a recession

Doing a little work upfront can help you and your family get through a Canada recession together.

Create a budget

Now is a good time to create or update your family budget so it accounts for the higher costs of living. Track your family’s daily spending habits and the current inflated costs of what you purchase. Ask your kids to think about which items they can live without. Then, create a realistic budget for your new reality.

Build an emergency fund

Having emergency savings can help you pay for unexpected costs or price increases. It also helps with peace of mind. Show your kids the ways you’re cutting back to divert money into your emergency fund. Ask them to do the same and create their emergency fund. If emergencies don’t arise, at least they’ll have some bonus money to spend later on.

Pay down credit card debt

With interest rates high, it’s a good time to pay down debts as quickly as possible. The Financial Consumer Agency of Canada suggests taking action by cutting back on expenses, paying off debts with the highest interest rates, avoiding new debt, and having a plan in case you can’t make a payment. If your kids have debt, discuss ways to keep things manageable. Help them analyze their statements and work out a payment schedule to meet their repayment goals faster.

Read more: How to pay off debt fast: A guide for parents and teens

Find creative ways to save

There are lots of ways to have free fun and now is a good time to think of ways to cut back. Watch videos about fun ways to repurpose or upcycle clothing and household items, instead of buying new. Research budget-friendly recipes you’ll all enjoy. Ask kids to find ways they can reduce the cost of social outings. If they head to the movies on Friday nights, suggest they choose to watch a movie at home with their friends, or bike to a friend’s house instead of driving.

How to talk to your kids about a recession

Recessions are stressful for kids and parents alike. Let your kids know it’s okay to talk about their fears. Help them understand the big picture of economic cycles, and that while sometimes the economy is down, it eventually bounces back. Be honest but make conversations age appropriate. Focus on fun ways to save and reduce costs, without scaring them or downloading your financial pressures onto them.

Recessions are full of unknowns but the lessons you teach your kids now can empower them to take control of their finances and learn valuable lessons for the future.

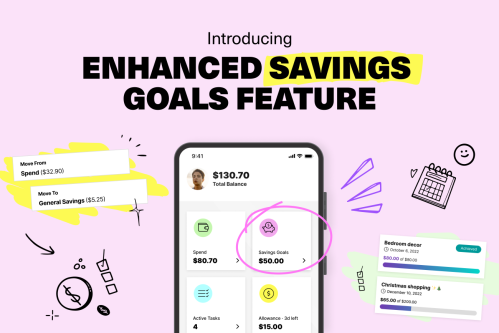

Download Mydoh and help build the foundation of financial literacy for your kids and teenagers.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.

Teach Your Kids How To Earn, Spend & Save Money

with the Mydoh App &

Add up to five kids and two parents on one account.