Whether you’ve just arrived or are planning to move to Canada, navigating the Canadian banking system on your own can be challenging. For newcomer parents, you’re most likely trying to seek financial advice on how to open the proper bank accounts and start investing to reach your savings goals, such as buying your first home or sending your kids off to college or university someday.

When you’re adjusting to living in a new country, understanding the various financial products can be quite confusing. Fortunately, we’re here to help newcomer families understand some common financial products you’ll find in Canada, how they work, and when they should be used.

Read more: How the financial system works in Canada.

1. First Home Savings Account (FHSA)

In 2023, the Canadian government introduced the First Home Savings Account (FHSA), a registered plan to assist first-time homebuyers in purchasing or building their first home in Canada.

Newcomers may find this product appealing as it gives them the opportunity to grow their money tax-free (like the TFSA), and contributions are tax-deductible (like an RRSP). Having this account can help you set aside and invest money for a down payment on your future home.

How does a FHSA work?

To qualify for the FHSA, you must be 18 years or older and a resident of Canada. You must also be a first-time homebuyer, and you and/or your spouse or common-law partner cannot have lived in a home that either of you owned within the past four calendar years.

With the FHSA, you can contribute up to $8,000 annually, with a lifetime maximum amount of $40,000. If you don’t contribute up to the $8,000 annual limit, any unused contribution room can be carried forward to the following year. To optimize how you save for your first home, you may consider using the FHSA and the Home Buyers’ Plan (HBP) together.

2. Guaranteed Investment Certificate (GIC)

If you want a safe investment product that will give you a fixed income without losing your money (called a deposit), then a Guaranteed Investment Certificate (GIC) may be an appealing choice. Essentially, you’re lending money to the bank or financial institution. In return, they offer you a specified interest rate. GICs are available at banks, credit unions, investment firms, and trust companies.

How does a GIC work?

You can purchase a GIC if you’ve reached the age of majority in your province. GICs offer set terms such as for six months, one year or up to ten years. Typically, the longer the term, the higher the interest you can earn. Most GICs offer a fixed interest rate, but there are variable rate GICs that are linked to how well the stock market is performing.

Keep in mind that you usually need to lock in your money until the term is over (known as the maturity date). However, if you anticipate that you may need your money earlier, look for a redeemable GIC that doesn’t charge you penalties for withdrawing your money early.

Read more: Investing 101 – A guide for parents and teens.

3. High-Interest Savings Account (HISA)

Saving up for a rainy day can be done through a High-Interest Savings Account (HISA). A HISA offers a higher interest rate compared to a regular savings account. Current HISA rates range between 3% to 6% and some financial institutions may offer a welcome bonus.

There are many benefits for newcomers to own this account, such as keeping your money in a safe place and having it easily accessible, and your money is earning interest so you can reach your future goals faster. A HISA is generally available through traditional banks, online banks, and credit unions.

How does a HISA work?

The HISA is a safe product as your funds are insured by the Canadian Deposit Insurance Corporation (CDIC), up to a maximum of $100,000. Typically, HISAs don’t require a minimum balance, and they don’t charge monthly fees. To be eligible to open a HISA, you’ll need to be a resident of Canada and have reached the age of majority in your province.

One of the perks of a HISA is that it allows you to earn a modest interest without losing money. Compared to a Guaranteed Investment Certificate (GIC), you don’t need to lock in your money for a certain period of time. So, if you’re saving up for a family vacation, this may be a suitable option for you.

4. Home Equity Line of Credit (HELOC)

Whether you’re buying a home or are an existing homeowner whose mortgage is up for renewal, you may consider a Home Equity Line of Credit (HELOC). A HELOC is a revolving credit product (like a credit card) that allows you to borrow equity from your home, pay it back, and borrow it again. Newcomers may lean towards this financial product because it allows you to take money out to pay for a renovation, your child’s education, or buy a car.

The pros of owning a HELOC include:

- Allowing you to borrow up to 65% of your home equity.

- Preventing numerous credit applications.

- You can take advantage of competitive interest rates.

The cons of owning a HELOC include:

- The variable interest rate on the HELOC may cause your repayment amounts to increase.

- Being unable to repay the debt due to an injury, illness or job loss.

- With easy access to the funds, it may lead you to go into debt and diminish your assets.

How does a HELOC work?

To use this loan, it acts like a bank account where you can access it online or through an automated banking machine (ABM) to make transactions. It’s wise to set up an automated payment each month so you’re paying the monthly interest on the amount you’ve withdrawn.

To qualify for a HELOC, you’ll need to pass a “stress test” used by financial institutions to prove that you are able to repay your debt. You’ll need to have a minimum down payment of 20% to get a readvancable mortgage (which combines a HELOC with a mortgage), or a 35% down payment if you want a stand-alone HELOC.

Plus, you’ll need a decent credit score and proof of employment with stable income. If you’re looking for a HELOC on your current home, you’ll need to provide proof that you own the home, mortgage details, and have your lender assess your home’s value. Your home will need to be registered as collateral which a lawyer or title service company can do for you.

5. Registered Education Savings Plan (RESP)

One of the ways parents can ensure there’s money to pay for your child’s university tuition and textbooks is to start saving now with a Registered Retirement Savings Plan (RESP).

In Canada, this registered plan helps you save towards your child’s post-secondary education, and the money grows tax-deferred until it’s withdrawn. When your child withdraws money from their RESP, they will need to pay tax on it. However, since your child will likely have little or no income while studying in school, they will be taxed at a lower tax bracket.

Plus, you can take advantage of the government’s matching program through the Canada Education Savings Grant (CESG) which matches 20% of your annual contribution of up to $2,500 (maximum of $500), with a lifetime total per beneficiary is $7,200.

The government also provides a top-up for low-income families with the Canada Learning Bond (CLB). Eligible beneficiaries can receive $500 within the first year and an additional $100 for each year they are eligible until the age of 15, with a maximum limit of $2,000.

How does an RESP work?

Although the RESP doesn’t have an annual contribution limit, the lifetime limit is $50,000. You can purchase savings and investment products such as GICs, stocks, bonds, index funds and more. Funds from the RESP can be used to pay for education-related costs in either a full-time or part-time program at a post-secondary institution.

Canadian residents can open an RESP as soon as their child is born and they have a Social Insurance Number (SIN). Most banks, credit unions and financial planners will offer RESP products. You will need to choose between an individual, family or group RESP, where each of them have different rules to follow. The sooner you open and contribute to an RESP, the more time you’ll have to grow your money to help pay for your child’s post-secondary education.

6. Registered Retirement Savings Plan (RRSP)

The Registered Retirement Savings Plan (RRSP) is an investment account created by the government to help you save for your retirement. There are numerous benefits to contributing to an RRSP. For instance, it helps to reduce your taxable income and you can use it to help invest for the future. Plus, you can use this account to access the Lifelong Learning Plan (for post-secondary education) and the Home Buyer’s Plan (to buy a home).

How does an RRSP work?

The amount you contribute to your RRSP will help to reduce your taxable income which can help to lower your tax bracket or reduce your marginal tax rate. Every year, the RRSP contribution limit is up to 18% of your gross income or up to the annual limit, whichever is the lesser amount.

To qualify for the RRSP, you need to be a Canadian citizen or permanent resident. Since you need some employment income to contribute, typically, newcomers will file their first annual tax return before opening an RRSP. You can visit a bank, credit union, trust or insurance provider to open this investment account.

Ideally, you don’t want to withdraw your money until age 65, which is the retirement age set by the Canadian government. However, if you find yourself in an emergency situation where you need to take money out earlier than 65, then you will be taxed on it because it’s considered income.

Read more: RRSPs explained for parents and teens.

7. Tax Free Savings Account (TFSA)

If you’re looking for a flexible way to invest your money and withdraw it at any time, then the Tax-Free Savings Account (TFSA) may be a good fit for your family.

It’s a popular choice for newcomers because the money you contribute can be invested and when you decide to sell your funds and withdraw the money from your TFSA, it’s not taxed. But remember, any amount you withdraw, you will have to wait until the following year on January 1 to put that amount back into the account.

Compared to the RRSP, you don’t have to lock in your money until age 65 for retirement. That means if you need to take money out to use it for a down payment on a house, to buy a car or pay for an emergency, it can offer this flexibility for newcomer families.

How does a TFSA work?

This program was introduced in 2009. Every year, the government determines the contribution limit, which ranges from $5,000 to $10,000. In 2024, the annual contribution limit is $7,000. To determine your lifetime contribution limit, look up the year you (or your kids) turned 18 and add up the annual amounts to get to your total. Also, when you’re contributing to your TFSA, you’re using your after-tax dollars.

Any resident of Canada who is 18 years or older and has a social insurance number (SIN) can open a TFSA account. You can open a TFSA with any big bank or many online banks.

While you can use your hard-earned money as a savings account, you may consider investing it in the stock market (by buying stocks and bonds) so that you can take advantage of compound interest. If your money grows, it’s tax-free which is a great incentive to invest your money so that you have the opportunity to achieve your long-term goals faster.

Your family’s financial future starts now

There’s no doubt that moving to a new country can put you out of your comfort zone. Hopefully, this guide has given you a better understanding of which savings and investment vehicles could be beneficial for your family.

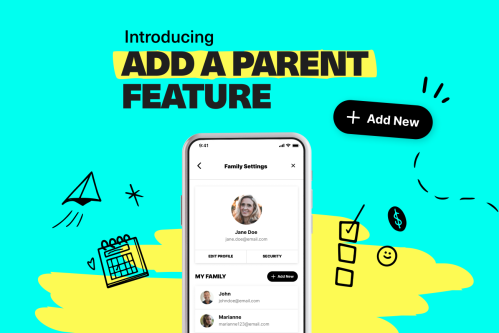

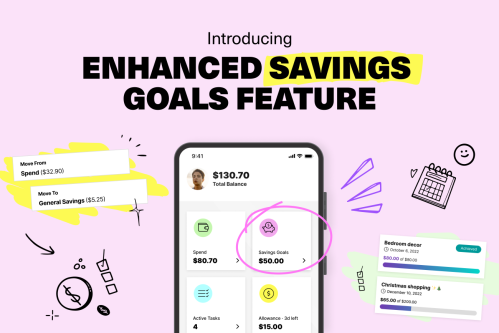

As parents, you can help your kids learn about managing money at a young age so they can build the confidence to make smart money decisions and take charge of their financial future. Mydoh is there to help.

Download the Mydoh app for no monthly fee and help your kids learn how to earn, spend, and save their own money.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.

Teach Your Kids How To Earn, Spend & Save Money

with the Mydoh App &

Add up to five kids and two parents on one account.