Maybe you’re ready to teach financial literacy to your kids, but you’re not sure where to start? From counting games for youngsters, to planning investments with teens, there are countless ways to raise financially savvy kids—no matter what age you start.

Here are ideas to jumpstart (or expand) your efforts to teach kids from aged four to 16. Keep in mind, this is not an exhaustive list. Feel free to pick and choose suggestions that best fit your kids’ level of knowledge and interest, adding your own as learning opportunities arise.

Activities that teach financial literacy to kids aged 4 to 6

Even at a young age, kids grasp how money works, making this an ideal time to expand on basic money concepts like exchanging money for goods, saving to reach a goal, and charitable giving. Keep it simple and fun to open the door to healthy communication about finances as they grow older.

1. Count coins

Grab a stack of change to teach the names and values of different coins, encouraging your child to stack, count, and name them. Ask them to provide you change, like a quarter for two dimes and a nickel, to deepen their understanding of a coin’s value.

2. Play shop

Set up an imaginary shop with items from around the house so kids can select and pay for items they want using real or pretend money. You can also give them a pretend credit or debit card to ‘tap’ or ‘swipe’ and teach how purchases are made without the exchange of physical dollars and coins.

3. Pay at the grocery checkout

Bring your child to the grocery store and when you hand cash or debit card to the cashier, explain how you’re paying for the groceries that were rung through. You can invite your child to hand the money or tap your card. If it’s a debit card, explain that the money is being taken out of your bank account and that, no, groceries are not free!

4. Use a piggy bank

Set up a piggy bank or saving jar in your child’s bedroom to drop coins they’ve earned through small tasks around the house, from birthday gifts, and more. Encourage your child to count out their money every time they add to their savings to see how much it’s grown. Set a goal to purchase something small with their savings.

5. Give to others

Invite your child to drop loonies and twoonies in a donation box during shopping excursions, explaining how their contribution helps important causes. Encourage them to donate their old toys, books, or clothes to a charity so that other kids can enjoy them.

Read more: Money games for kids.

Activities that teach financial literacy to kids aged 7 to 9

Kids in this age range have advanced their problem-solving skills, can concentrate longer, and are more independent. You can ramp up your efforts to deepen their financial literacy with real life experience such as independently making purchases, earning an allowance, staying safe online, and understanding good value for their dollar. By this age, if your kids are spending a lot of time online, discussions about the influence of marketing can sharpen critical thinking skills and help curb impulse spending.

1. Make a purchase independently

Let your child purchase items as you supervise from afar. This exciting act of independence offers the added safety of you nearby to boost their confidence. Later, review the receipt together to describe how items tally up, tax, and method of payment.

2. Pay an allowance for chores

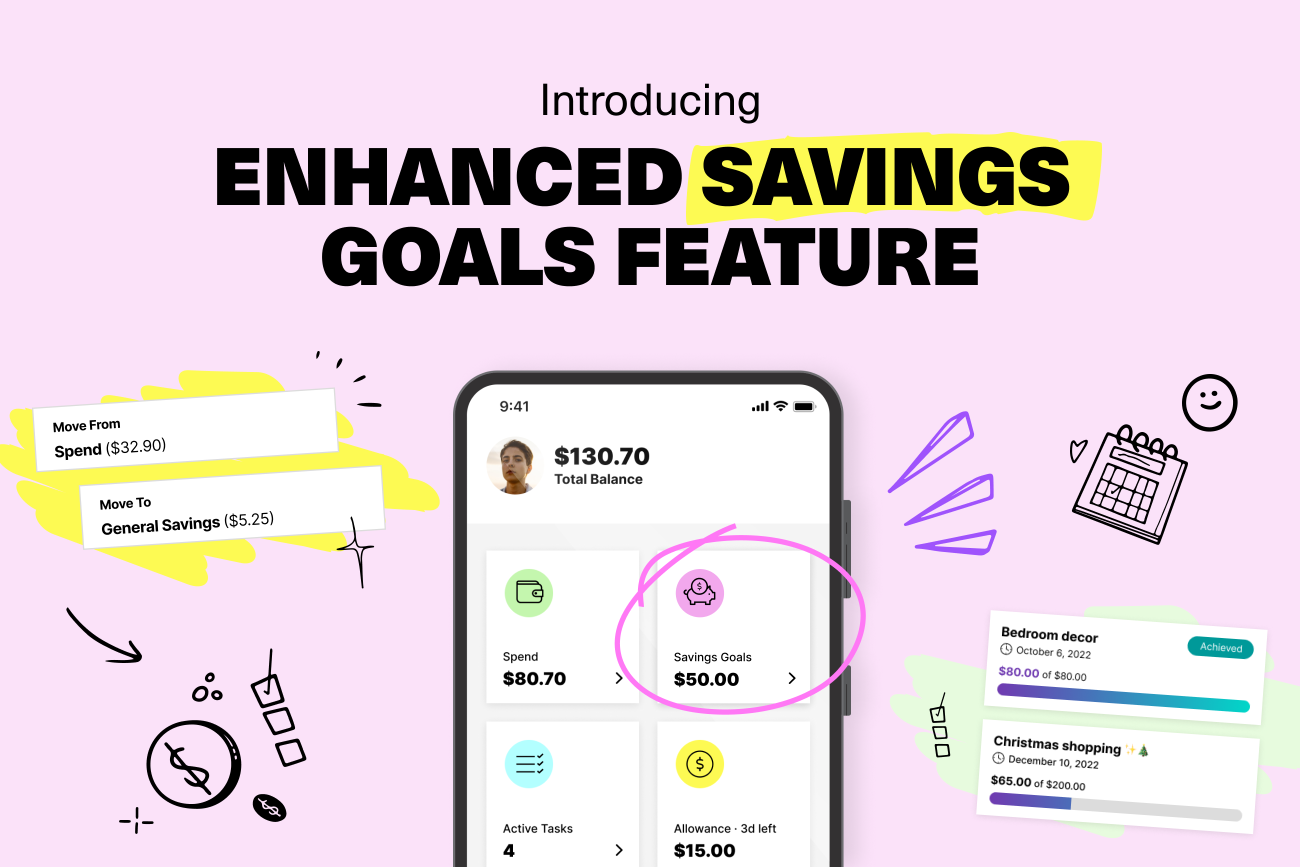

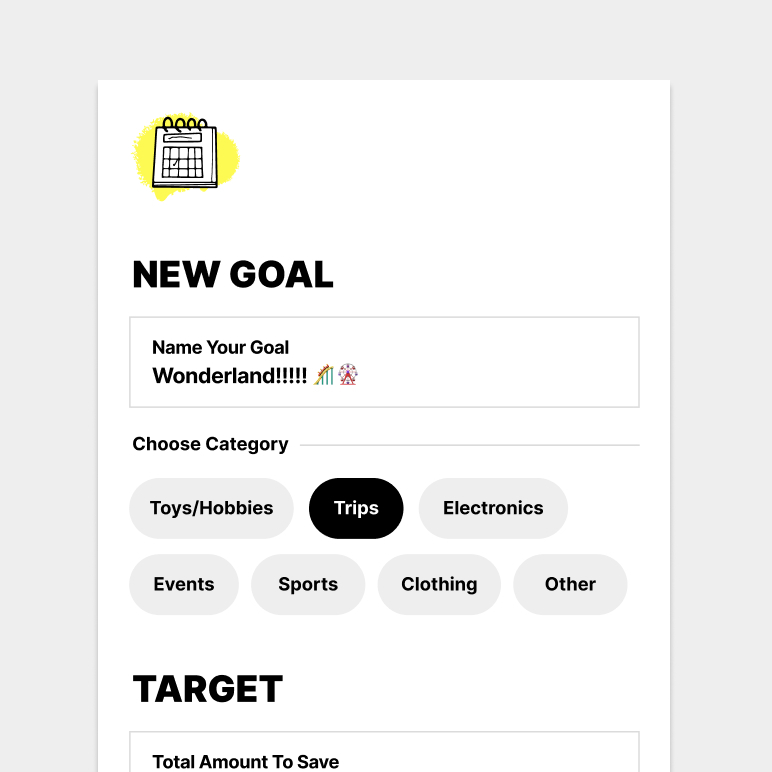

Introduce a chore-based allowance starting with basic household duties that need to be completed weekly to earn a predetermined amount of money. Using an app like Mydoh makes it easy to track tasks and payments on a digital platform that helps familiarize your kids with online banking.

3. Visit a brick-and-mortar bank

Visit the bank, in person, to open a savings account for your child. Encourage them to save up some money for their very first deposit.

Read more: What is a bank and why do they exist?

4. Introduce saving jars

For kids who prefer a more hands-on approach to learning about finances, give them three saving jars to get them used to responsibly allocating their earnings: one for saving, one for spending, and one for sharing (charitable giving).

5. Online shopping

When you shop online, invite your child to watch as you go through a typical ecommerce process. Explain how you compare products, add items to cart, review the costs that make up the total, and checkout.

6. Comparison shop

When you’re out shopping, explain how you compare brands by factors such as price, volume, and quality to get the best value. Point out products that are on sale and ask them to help calculate the savings.

7. Stick to a budget

Visit a favourite store and let your kids purchase anything they want with their savings, as long as it’s within the budget. Try not to sway them too much from making a purchase you don’t think is good value for their dollar. It’s important to let them learn on their own. Instead, ask questions to get them thinking on their own.

8. Encourage a charitable mindset

Help your child develop a charitable mindset by talking about different charitable causes. Find out what your child feels passionate about. Child poverty? The environment? Caring for the sick? This may spark a desire to support a particular charity through a donation, and the realization we can help others in need through the simple act of donating.

9. Explain virtual vs. in-person purchases

Explain the difference between buying things virtually and in-person. Today, just about every online video game has an ecommerce function encouraging users to buy virtual products to improve the game experience. When kids start asking to buy goodies for their video game avatar, it’s time to compare virtual goods with physical goods: “The amount you want to spend on your avatar’s makeover equals $20 in real life, which is the same cost as the toy you asked for at the store last week. Which one do you prefer?”

Activities that teach financial literacy to kids aged 10 to 12

Kids in this age group are on the cusp of adolescence and developing greater independence as they identify their own unique interests and skills. As they become more self-conscious, they may draw comparisons among peers to figure out where they fit in. Their list of wants may grow more specific, but they’re also able to budget for what they want if they’re earning an allowance or saving birthday money.

Parents may need to let go of some control to allow kids to make mistakes with their money and learn natural consequences. This is an opportune time to help kids grow comfortable discussing money and confidence in how they use it, introducing more advanced financial concepts like budgeting and investing.

1. Earn more money

In addition to a regular allowance and weekly chores, provide opportunities to earn extra income through additional tasks around the house to boost their savings and help them reach their savings goals more quickly.

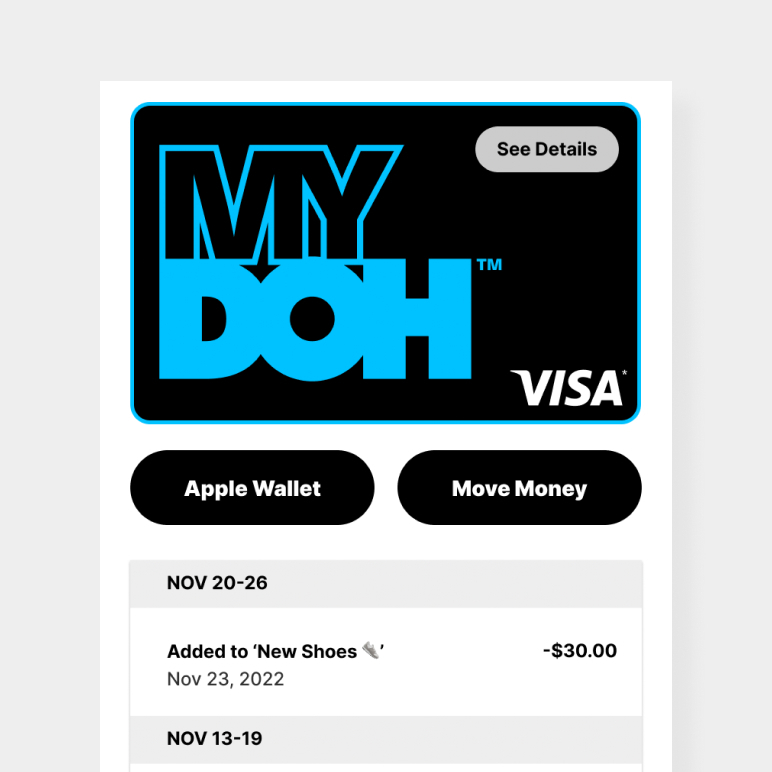

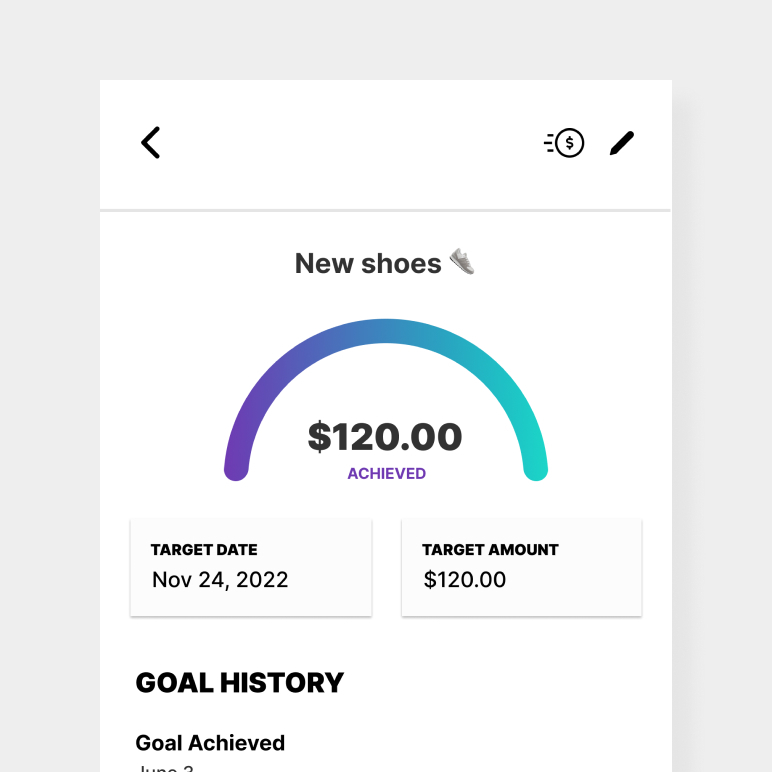

2. Introduce a debit card

Strengthen your kids’ financial independence with a debit card. Alternatively, a kid-friendly app, like Mydoh, provides kids with their own Smart Cash Card—a reloadable prepaid card that can be used in-person and online. This is also a good time to teach your kids why it’s important to check their bank balance regularly.

Read more: What parents need to know about debit cards for kids.

3. Discuss money at the dinner table

Spark lively dinner discussion about money. Encourage questions and be open to exploring all goals related to money—no matter how outlandish they may seem (like I want to be a millionaire YouTuber or I want my first car to be a Lamborghini). Use these as opportunities to discuss cost of living, incomes, savings, and more. The more kids can relate personal finance to their own dreams, the more inspired they’ll be to make money smart decisions that help achieve those aspirations.

4. Level-up their online safety

As kids spend more time online, it becomes harder to keep track of their digital habits. Level up their online safety know-how. Teach them how to protect account information and passwords and emphasize the danger of opening links on a website or in messages (no matter how tempting they may be to click), even if they appear to be from a friend or trusted business like a bank.

Read more: What kids and teens need to know about online privacy.

5. Donate to their favourite charity

Now that you’re talking about money at dinner, bring up the topic of charitable organizations. Discuss and investigate different charities and select one that the entire family can support—either through one big donation everyone contributes to, or monthly donations which can keep the conversation going all year if the organization provides updates.

6. Introduce investing

Learning to invest could reap serious rewards. Introduce kids to investing by explaining some of the basics, such as how the stock market works, and how compound interest can help grow their savings.

Read more: Investing 101: A guide for parents and teens.

7. Practice crunching the numbers

Introduce the concept of a budget and how it works. Encourage your child to choose an item they want to purchase to highlight the usefulness of setting a financial goal and developing a basic plan to attain it. The plan may include weekly savings needed, extra income opportunities such as chores, and a timeline. Mydoh’s money calculator can help them calculate how much they can save based on how much they earn and spend.

Activities that teach financial literacy to teens aged 13 to 16

As kids progress through the teen years, they crave more independence and responsibility. They better understand the benefit of earning their own money to pay for the things they want and are often motivated to work a part-time job to boost their autonomy. Your teen is capable, and often willing, to look farther into the future with more concrete aspirations, such as post-secondary studies and careers.

Helping them develop the financial savvy to prepare for their future is key. In only a few years, your teen may be ready to live independently, so this is a crucial period to set up smart money habits and build financial confidence. Peers and social media can have a tremendous influence on your teen, including how they earn, spend, and save money. Be sure to continue to build on your teen’s financial literacy in a supportive way—finding the right balance between their desire for autonomy and responsible savings habits.

Read more: 10 money mistakes that teens make and how to avoid them.

1. Make informed purchases

Encourage your teen to research before making large purchases by comparing prices and reading online reviews. With a broader understanding of the world’s issues, you can also encourage them to consider how a product choice may impact the environment, and whether they’re willing to pay more for a product that’s made sustainably.

Read more: How to spend according to your values.

2. Try a practice investment account

Encourage your teen’s interest in investing by discussing the different types of investments, such as mutual funds, ETFs, TFSAs, and risk tolerance. This may not appeal to every teen, so gauge the level of interest rather than force it. Some banks, such as RBC, offer practice accounts where teens can try their hand at buying and selling stocks and ETFs, track their holdings, and view performance in real time.

3. Pay the household bills

Don’t be afraid to share some of your bills with your teen to provide a sense of what it costs to run a household today. It will likely come as a surprise when they discover the various payments due each month to cover services such as a phone plan, internet, heating, car insurance, and more. Arming your teen with this knowledge can help instill good habits such as budgeting, energy conservation, taking care of possessions to avoid replacement costs, and even driving more carefully.

Read more: Budgeting 101: A guide for parents and teens.

4. Create a real-world budget

Once your teen starts thinking about post-secondary plans or career choices, they need to get real about the costs. How much does an average first year cost? How much will your teen need to contribute? How much do different programs cost? These discussions can help determine how much your teen needs to save, along with a plan to meet that goal within a certain time frame—in essence a real-world budget.

5. Track expenses

It’s easy to lose track of how much money you spend when almost every transaction is online. Gone are the days when an empty wallet meant no spending. Help your teen develop a better awareness of spending habits by reviewing where the money is going. Teens can review their past transactions through their online bank account and divide expenses into categories such as, takeout, clothes, and video games. Ask them to report back to you on what they learned. The exercise can be enlightening for teens who struggle to keep a balance above zero, regardless of how much money is earned, and may jumpstart efforts to spend more wisely all on their own.

Read more: What is a zero-based budget?

6. Discuss credit card debt

Once your teen starts post-secondary studies, they may want to get a credit card. But don’t wait until then to teach responsible credit card use. Although making mistakes is an important part of learning financial literacy, irresponsible credit card use can be extremely costly, and may cause long-term damage to credit scores. Share your credit card statements with your teen and explain that the balance should be paid in full each month to avoid paying high interest rates that add a lot more cost to that bracelet or pair of sneakers that was a fun splurge.

Read more: How to apply for your first credit card.

7. Encourage them start a business

Have an entrepreneurial teen? Whether it’s mowing lawns, babysitting, computer programming, or launching an ecommerce shop, running a business is fertile ground for learning about finance and economics. It can provide real life experience in supply and demand, managing debt, investing, and more. You can encourage this in various ways, including providing a small loan, reviewing their business plan, and marketing through word-of-mouth.

Prepare your kids for a financially secure future

Learning how to be responsible with money is like any life skill – it gets stronger with proper guidance, personal experience, and commitment to learn. You can help your kids and teens sharpen their money smarts while they’re young, so they’re better prepared for the financial challenges that inevitably arrive with adulthood.

Download Mydoh and get started today.